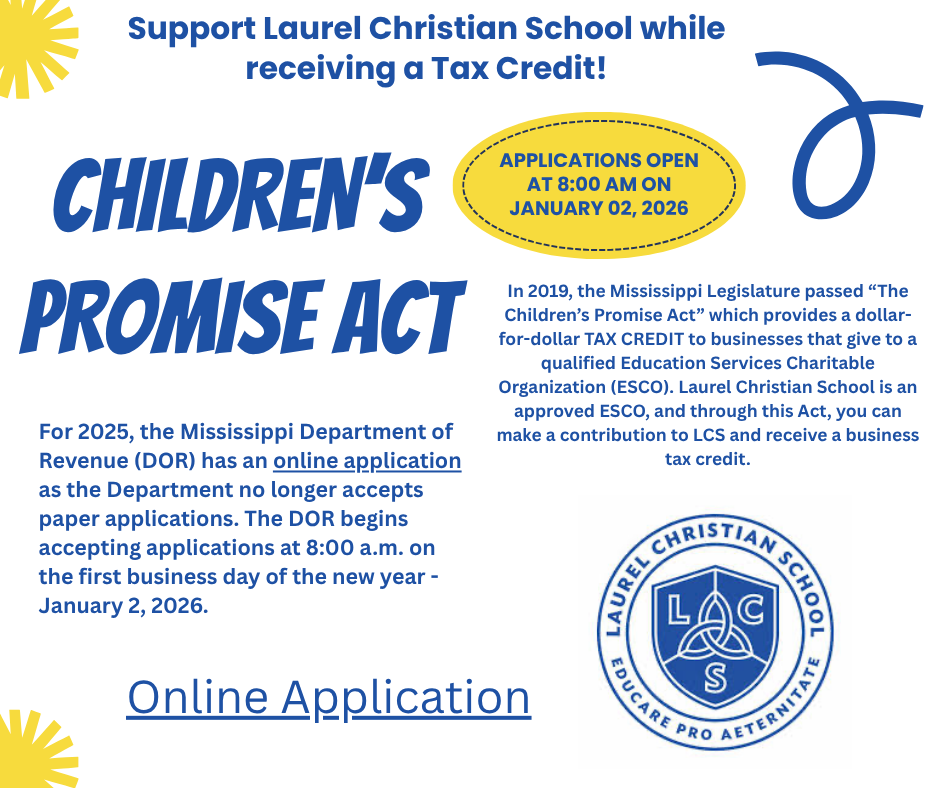

Children's Promise Act

Support Laurel Christian School While Receiving a Tax Credit

In 2019, the Mississippi Legislature passed “The Children’s Promise Act” which provides a dollar-for-dollar TAX CREDIT to businesses that give to a qualified Education Services Charitable Organization (ESCO). Laurel Christian School is an approved ESCO, and through this Act, you can make a contribution to Laurel Christian School and receive a business tax credit.

What is the process?

Once you click on the online application link, there will be an “Apply for a Charitable Contribution Credit” link in the “Apply Online” section. Simply complete the online form by selecting “ESCO” as the “Type of Charitable Contribution Credit”, entering the requested company-specific information, and selecting “Laurel Christian School” from the dropdown menu as the “(Primary) Name of the Organization to Receive the Contribution”. Complete the application by entering the contribution amount and expected date of contribution, review your information, and submit — it’s that simple!

What is the Due Date?

For 2025, the Mississippi Department of Revenue (DOR) has an online application as the Department no longer accepts paper applications. The DOR begins accepting applications at 8:00 a.m. on the first business day of the new year - January 2, 2026.

More details

- Total Maximum Program Allocation: $9,000,000

- Limits on Total Allocation of Credit: Business Taxpayers (Corporations, Partnerships, Limited Liability Companies, and Sole Proprietorships)

- Tax-Types that Credit can be used against: Income Tax (50% of tax liability), Insurance Premium Tax (50% of tax liability), Insurance Premium Retaliatory Tax (50% of tax liability), Ad Valorem Tax (for entities not operating as a corporation, 50% of real property tax liability)

- Carry Forward: 5 years

- Other Limitations: Contributions cannot be used for other state charitable credits and cannot be used as a deduction for state income tax purposes.

- Applications for the tax credit must be made on official Mississippi Department of Revenue forms.

Please Consider Supporting Laurel Christian School

Please consider listing Laurel Christian School as either your first or second option for the company selection. Keep in mind that there is a statewide cap of $9,000,000 for this program, and the maximum amount any ESCO can receive is $405,000. Allocations are made on a first-come, first-served basis, so all available funding will likely be exhausted very early on the first business day of the year. Once the statewide cap is reached, no additional applications will be approved.

If you are considering a new gift under this program to Laurel Christian School or would like to discuss this further, please contact Jamie Rogers at jrogers@laurelchristian.org and/or your tax professional.

Laurel Christian School will be happy to file this information on your behalf.

Information provided in this communication is not tax advice. Please consult a tax professional regarding your specific tax situation.